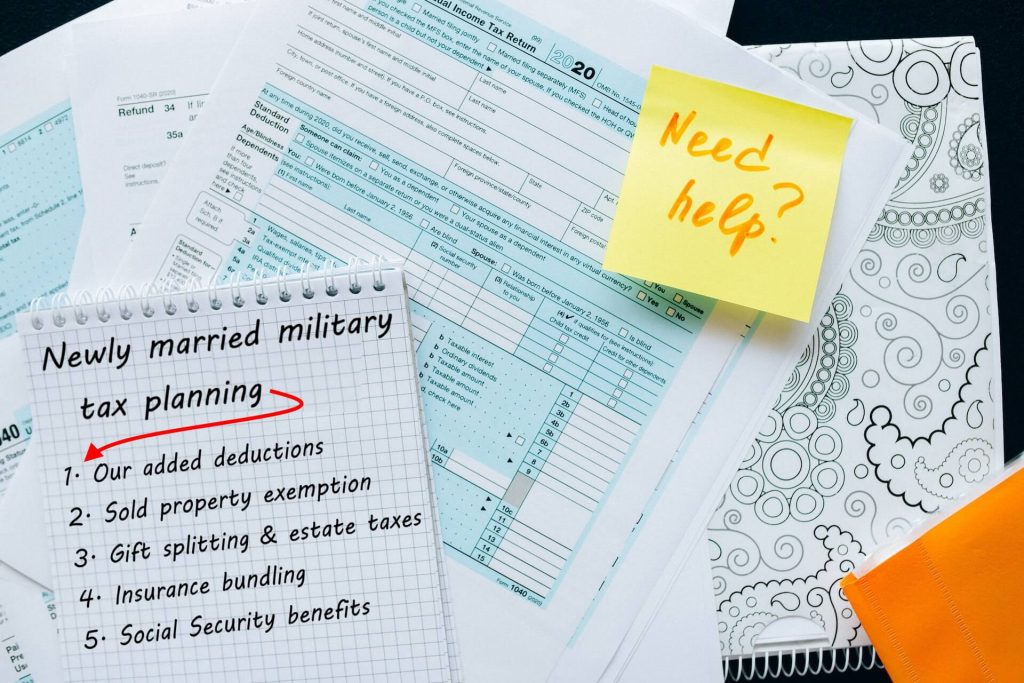

Are you planning to get married next year? Or maybe you want all of the tax benefits of being married now which will get you all the benefits this year? Here are 5 tax advantages to getting married in the military now:

Getting married prior to December 31 of each year allows the most beneficial tax outcome when married filing jointly. Most deductions and credits are reduced, even if you’re only married one day of the prior year. The beauty of being married the prior tax year is only having to file one return, added gift giving benefits, retirement deductions, lower capital gains and social security benefits.

Tax Advantages for Married Couples

These are 5 of the best reasons to get married now to save money on your taxes for the next year. Even getting married late in December will afford you to claim mostly all of the prior year when filing. We urge you to speak with a tax professional about these and other tax related issues.

When You Can File Your Taxes as Married Filing Jointly

When married, you and your spouse should decide on whether to file either a joint or separate tax return. A joint return can be filed even if one of you had zero income for the year.

You can file Married Filing Jointly if the following statements are true:

- You and your new spouse both agree to file a joint tax return

- You were married on the last day (December 31) of the tax year.

As a married couple, neither of you can file as single. You can either file married jointly or married filing separately. This is the case unless your marriage was annulled, legally separated or legally divorced. If you are married at any time of the prior year and attempt to file as single, the IRS will reject your filed return.

Non-Resident Aliens or Dual-Status Alien married to a U.S. citizen or resident alien? You are eligible to file a joint tax return. A non-resident spouse will be treated as a U.S. resident for the entire tax year when filing jointly.

Note: You can not claim your spouse as a dependent.

File Together for More Deductions

Being married offers you the opportunity to file jointly thus lowering your tax rate with higher deductions. You may be able to claim other exemptions such as student education tax credits, student loan interest, childcare expenses.

Social Security Benefits May Be Increased

Look, being in the military is a dangerous occupation. You can never tell what will happen where you’re stationed. So a significant advantage of marriage is being eligible for spousal Social Security survival benefits.

As a married couple, you’re each eligible to collect your own Social Security benefit or up to 50 percent of your spouse’s benefit, whichever is greater. This can be a financial plus if one of you earn more.

Just going to add here; widowers are eligible to collect up to 100% of the spousal benefits. In the case of a parent that is deceased or disabled, Social Security could provide benefits for children.

Buying or Selling a Home or Land

Do you own a home that has gone up in value? Filing jointly may allow you to exclude up to $500,000 – your exception is that you’re military and subject o job transfers. If you owned the home before you got married and are deciding to sell after getting married, only one of you needs to meet the ownership test. Or if only one of your names was on the deed.

When selling a home or property, married couples holding joint ownership may receive capital gains exclusions of up to $500,000.

Gift Splitting and Estate Tax

As a married couple, you can transfer unlimited amounts of property to one another without reporting or paying gift tax. You could ultimately use gift splitting which doubles amounts you give jointly to a third party.

A spouse can leave an unlimited amount of money to their widow without paying estate tax. As well, the surviving spouse can use any unused portion of the deceased spouse’s lifetime estate tax exclusion up to $24.12 million free of federal estate tax.

Note: Gift splitting and gift tax reporting is only true if you’re both U.S. citizens. Again, please consult a tax attorney or licensed tax professional.

Insurance Planning for Auto and Home

While you’re both in the military and have excellent health care coverage, your vehicles and/or home insurance policies may be expensive. But as a married couple you’ll be able to bundle your policies bringing your premiums down. Check with your insurer to discover the endless benefits marriage affords.

Same Sex Marriage

A Treasury Department ruling (August 2013) states same-sex couples that were legally married must file as married filing jointly or married filing separately. Regardless of what states the couple resides, as long as they were legally wed in a state where same-sex marriage is legal (like Montana) must file jointly or separately.

What You’ll Need to File Your Federal Taxes

Filing federal (and state) taxes requires the following documents, pay stubs and receipts. The following is a list of some of most necessary documents:

- Photo ID|Military ID|Other Approved Form of Identification

- Social security cards for all persons listed on the tax return

- If married this year you will need a copy of your marriage certificate

- Last year’s state and federal tax returns

- Wage and earning statements. Ex: Forms W-2, W-2G, and 1099-R

- Child care costs and expenses

- Investment income forms

- Charitable donation receipts

- Deductible expenses list with receipts

- Bank routing numbers & account numbers is using direct deposit

W-2 forms are available near the end of January. Your W2 form can be downloaded from the MyPay website.

Where to Get Taxes Done For Free on Base?

The military offers military service members and their family free income tax filing through the VITA (Volunteer Income Tax Assistance) program. The VITA program have volunteers to help complete tax forms and complicated tax issues.

Note: You may be eligible for Combat Zone Tax Exclusion. Ask your tax preparer or licensed tax professional.

Conclusion

Marital tax changes could be complex, especially when there are properties to bundle, children, debt and expenses. It’s important to enlist the help of a licensed tax professional pro to help find marriage tax credits and deductions you may be entitled to. If you’d like information about Montana double proxy marriage service, please call 406.3717.5858 or send the team at WeddingProxy a message!